As we are in the midst of the RRSP season and the beginning of the income tax return season, I would like to remind you that we do offer income tax preparation services for individuals and businesses. Please contact me directly to schedule an appointment.

As we are in the midst of the RRSP season and the beginning of the income tax return season, I would like to remind you that we do offer income tax preparation services for individuals and businesses. Please contact me directly to schedule an appointment.

A few important items to keep in mind for the 2015 tax year:

- RRSP Contribution Deadline: February 29th 2016 for 2015 tax year. Yes, it is just around the corner. Why wait until the deadline? Do it as early as you possibly can.

RRSP Maximum Contribution Limit is $24,930 for 2015 tax year, or 18% of your earned income, whichever is lower, plus any unused contribution room from previous years. - Income Tax Return Deadline: May 2nd 2016 for most taxpayers. If you or your spouse carried on a business in 2015, you have until June 15th 2016 to file your return. However, your balance, if any, still has to be paid no later than May 2nd 2016 to avoid interest and penalty.

- If you are expecting a refund, file your return now and get back your money as soon as possible.

- If you are expected to pay, send in your return before May 2nd, even if you can’t pay your balance, to avoid late-filing penalty.

- T4/T4A Return Deadline: February 29th 2016, for 2015.

- Business GST/HST Return Deadline: June 15th 2016, for most GST/HST registrants, if you have an annual reporting period. However, your balance, if any, has to be paid no later than May 2nd 2016.

- Bought your home in 2015? If you are a first-time home buyer, you may be able to claim an amount of $5,000 for the purchase of a qualifying home in 2015.

- Got married/divorced in 2015? Your marital status impacts your taxes. Make sure to mention these changes to your income tax professional.

- Home Accessibility Credit: Introduced in the 2015 federal budget to help seniors, disabled persons and their families. However, this credit is only in effect for 2016. So if you are planning any eligible renovations, this year may be the year to do so.

Most companies and institutions have started sending out the receipts and T-slips. May I suggest you start a brand-new folder for those and keep them all in there as they arrive. This will make it much easier when the time comes for filing your income tax returns.

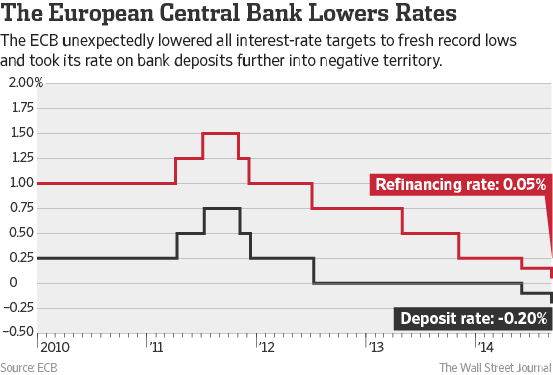

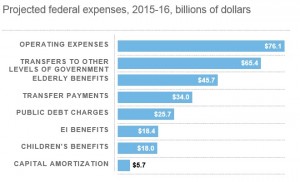

Finance Minister Joe Oliver delivered his first Federal budget on April 21st, 2015.

Finance Minister Joe Oliver delivered his first Federal budget on April 21st, 2015.