I trust that you have had a good 2019 so far and are looking forward to the holidays as well as the New Year.

As the year is coming to a close, it is time to do a year-end review, if you have not yet begun, and start planning for the coming year.

A few important items to consider for this year-end:

- TFSA: the contribution limit is $6,000 for 2019 and 2020 as well. If you have not yet made any contributions in the past, you can contribute up to $63,500 by the end of 2019 or $69,500 in 2020 (some conditions applied).

- If you are going to withdraw from your TFSA soon, it is best to do it before the end of the year (instead of the beginning of next year). This withdrawn amount will be reinstated in your contribution room in 2020.

- For Americans who reside in Canada, TFSA is not a tax-free account under IRS.

- RESP: you can receive the Canada Education Savings Grant (CESG) on the first $2,500 in contributions per year, or up to the first $5,000 in contributions, if sufficient carry forward room exists.

- If you have not yet contributed the above amount, consider doing so before the year-end to maximize your annual matching.

- If your child turned 15 this year, December 31st 2019 is your last chance for opening an RESP account for that child & starting the first contribution.

- RDSP: you can get a maximum of $3,500 in matching grants in one year. A beneficiary’s RDSP can receive a grant on contributions made until December 31st of the year in which the beneficiary turns 49.

- RRSP: you have until March 2nd, 2020 to make a contribution toward 2019 tax year.

- If you turned 71 in this year, December 31st is the last day that you can contribute to your RRSPs. Depending on your situation, you might want to consider over-contribution by the end of December (some restrictions & penalties applied).

- If you plan on withdrawing your RRSP under either LLP or HBP, consider delaying it to the new year to give yourself an extra year before the repayment required.

- If you are making payments on your LLP or HBP, talk to us or your tax advisor to see if it is to your advantage to miss or to make the required payment for the year.

- Medical Expenses: This has been one of the most under-claimed areas. The 12-month rule allows you to claim any 12-month period ending in the tax year for yourself, your spouse and your eligible dependents.

Depending on your situation, you might want to prepay certain medical expenses to claim the expenses for this tax year. - Other Tax-Deductible Expenses: such as deductible accounting & legal fees, other professional fees, business-related expenses, child care expenses. Make sure to pay them by December 31st.

- Moving? Choose your move date wisely, as tax rates vary between province to province. If you are to move to a lower tax province/territory, you might want to do so before the end of the year. Otherwise, consider delaying it until the new year.

I would like to remind you that we offer income tax return and bookkeeping services.

If you need a hand, or would like to discuss these and/or other tax planning strategies and how they affect your financial future, contact us directly.

Remember to always “Dream It. Plan It. Live It.“

I am here to help you on your journey. Reach out if I can be of any assistance.

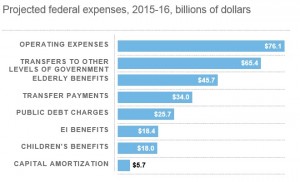

Finance Minister Joe Oliver delivered his first Federal budget on April 21st, 2015.

Finance Minister Joe Oliver delivered his first Federal budget on April 21st, 2015.